Hiring a remote bookkeeper can be a game-changer for businesses looking to streamline their finances while saving on overhead costs. However, it's crucial to consider several factors before making a decision. This article explores the essential considerations when hiring a remote bookkeeper to ensure a smooth and secure financial operation.

Common Tasks of a Remote Bookkeeper

Transaction Recording

Tracking daily financial transactions like sales, purchases, and expenses.

Payroll Management

Ensuring employees are paid on time and deductions are handled correctly.

Financial Reporting

Creating reports such as balance sheets, income statements, and cash flow statements.

Tax Preparation

Preparing necessary documentation for tax filings and ensuring compliance.

Invoicing and Payments

Manage accounts payable and receivable, send invoices, and ensure payments are processed on time.

Key Considerations in Hiring a Remote Bookkeeper

1. Experience and Specialization

Seek out a bookkeeper who has specific experience in your industry. Specialized knowledge ensures they understand the nuances of your financial needs and tax obligations.

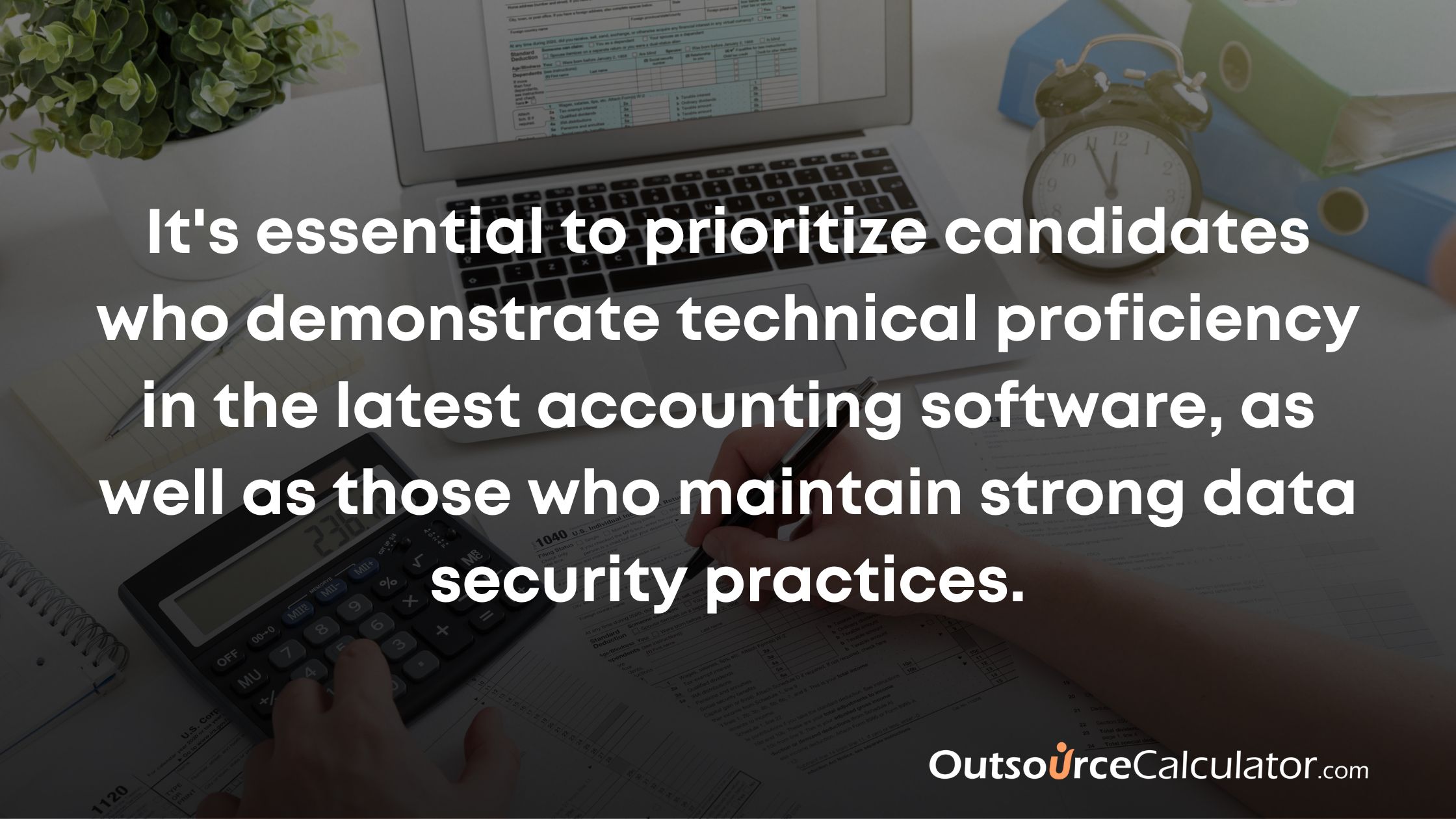

2. Technological Proficiency

Since the role is remote, your bookkeeper should be proficient in accounting software like QuickBooks, Xero, or other tools. Familiarity with cloud-based solutions is a plus, ensuring real-time access to your financial data.

3. Security and Confidentiality

Protecting your business's financial information is critical. Ensure that the bookkeeper follows robust security protocols, including using encrypted communication and secure document sharing.

4. Communication Skills

Remote work demands strong communication skills. A good remote bookkeeper should be able to explain complex financial details clearly and respond promptly to any queries you have.

5. References and Reviews

Check their professional references or online reviews. Prior clients’ experiences will give you insight into the reliability and quality of their work.

Conclusion

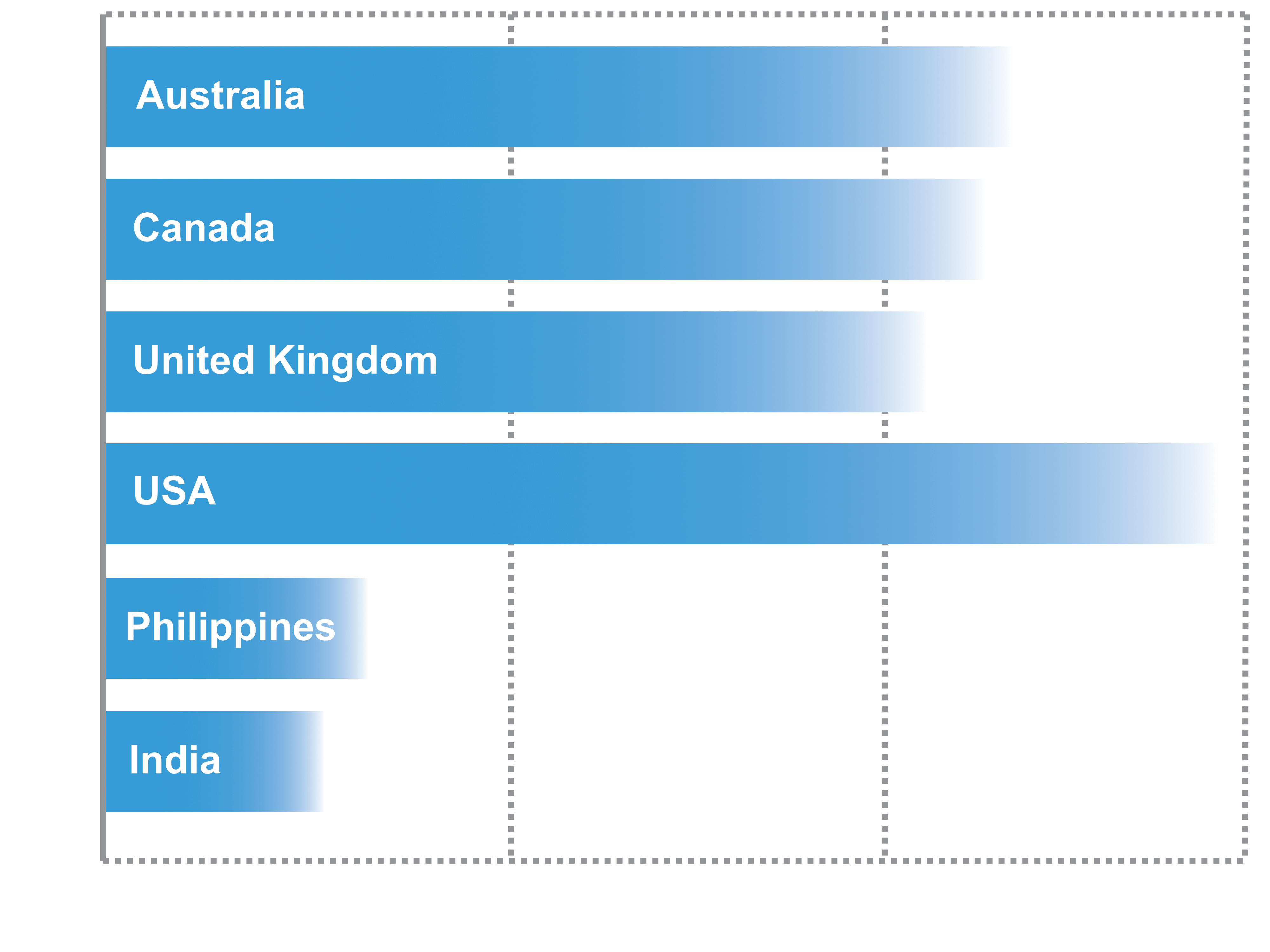

Hiring a remote bookkeeper can be a strategic move for businesses of all sizes, providing cost savings, increased flexibility, and access to a broader talent pool. However, this decision requires careful consideration to ensure you choose the right professional to manage your financial operations.

A qualified remote bookkeeper will not only handle day-to-day tasks like invoicing, payroll, and tax preparation but also provide valuable insights into your financial health. By outsourcing this critical function, you gain more time to focus on growing your business without compromising the accuracy or efficiency of your accounting processes.

Compute potential savings for your remote staff and virtual team member

Build Your Global Team and Save up to 70% on Labor Cost.

Recent Articles

About Outsource Calculator

Outsource Calculator helps boost your profits, increases quality and efficiency, and allows your business to scale quickly without expensive overhead.

Empowering

Get a FREE Quote & Save 70% on Labor costs!

The Outsource Calculator estimates the savings from outsourced staffing solutions compared to hiring locally, which is intended for informational purposes only. It provides approximate pricing only may not be accurate and should only be used as a guide and is not an official quote. You should not make any decisions based simply on the information provided. Outsource Calculator pricing is based on the typical employee salaries for each role, including all employee payroll taxes, government-mandated employee costs, employee technology required, office space, hardware costs, IT support, recruiting, training, onboarding, and all HR functions which provide a more accurate comparison with the outsourced staffing compared to local hiring.

United States

United Kingdom

Australia

Canada

Europe

Copyright © 2025 OutsourceCalculator.com All rights reserved. Privacy Policy Terms of Use